"Essential Due Diligence Tips for Verifying Title and Tax Declaration Alignment in Philippine Real Estate"

"Essential Due Diligence Tips for Verifying Title and Tax Declaration Alignment in Philippine Real Estate"

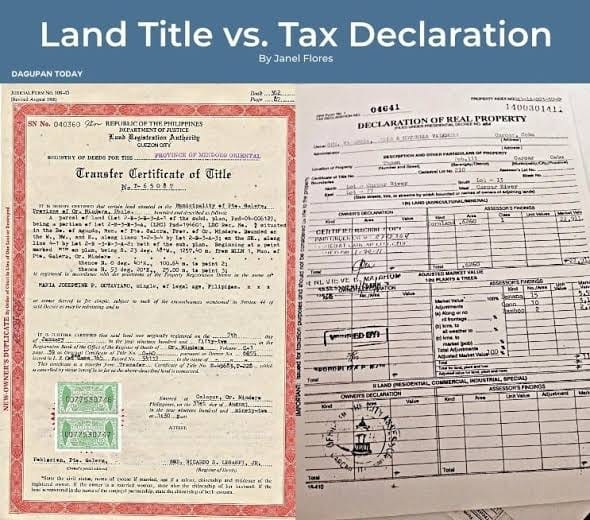

Here are enhanced tips for performing due diligence to make sure the title and tax declaration information are consistent:

---

1. Verify Registered Owner Information

Confirm that the name of the registered owner on the title and tax declaration match precisely.

Check for Complete Names: Ensure the names match exactly, including middle initials and suffixes if any (e.g., Jr., Sr.).

Verify with IDs: Request government-issued IDs from the seller to confirm that the registered owner is indeed the person selling the property.

Investigate Joint Ownership: If the property is co-owned, make sure all names appear on both documents, and ensure all owners are in agreement about the sale.

---

2. Ensure Consistency in Lot Area and Lot Number

The lot area and lot number should be identical in both the title and tax declaration, as any discrepancy could indicate issues like boundary disputes or clerical errors.

Compare Exact Measurements: Review the lot area as specified in square meters on both documents to ensure they match exactly.

Check Subdivision Plans if Applicable: In the case of properties within subdivisions, verify the lot number with the official subdivision plan to confirm accuracy.

Confirm with a Lot Plan: A licensed geodetic engineer can create or review a lot plan to ensure the official boundaries align with the information on both documents.

---

3. Examine Property Location and Address Details

The property’s address and location should be identical across all documents to avoid confusion, especially in cases where local addresses are complex or unclear.

Check Municipality and Barangay Details: Confirm that the property’s address, including the city or municipality and barangay, is consistent on both the title and tax declaration.

Assess Physical Markers: Visit the property and confirm physical boundaries to ensure they match the official location as described in the documents.

Map Out Coordinates if Available: For rural properties, some documents may include latitude and longitude coordinates. Compare these with a survey map or GPS to ensure accuracy.

---

4. Match Property Classification

Verify that the property classification (e.g., residential, commercial, agricultural) is the same on both documents, as inconsistencies can affect tax rates and usage rights.

Confirm Use in Both Documents: Ensure the classification matches on both the title and tax declaration to avoid potential zoning issues.

Cross-Check with Local Zoning Office: Confirm the property’s classification and allowed uses with the local zoning office, especially if you plan to develop the property.

---

5. Review the Boundary Details

If the title or tax declaration includes specific boundary descriptions (e.g., adjoining roads or neighboring properties), confirm that these descriptions are consistent and accurate.

Check with a Geodetic Engineer: A licensed geodetic engineer can help ensure the boundaries stated in both documents align with the actual physical boundaries.

Verify Boundary Markers on Site: Look for physical boundary markers like mojon (concrete boundary markers) to confirm they align with the boundaries described in the documents.

---

6. Assess the Property's Valuation

The property’s assessed value (found in the tax declaration) and fair market value should correspond closely with recent property valuations. The fair market value may also be referenced in the title if the property was recently appraised.

Ask for the Latest RPT Receipts: Recent Real Property Tax (RPT) receipts should reflect the same assessed value as the tax declaration, showing that property taxes are based on the accurate value.

Consider the Market Value: Compare the property’s assessed and fair market values with similar properties in the area to gauge if the valuation seems reasonable.

Use Valuation for Transfer Taxes: The fair market value will affect transfer fees, so having accurate values helps you prepare for the right transaction costs.

---

7. Cross-Verify Documents with the Registry of Deeds and Assessor’s Office

Both the Registry of Deeds and Assessor’s Office have official records of the title and tax declaration. Visiting these offices can clarify any discrepancies.

Get Certified Copies: Obtain certified true copies of the title from the Registry of Deeds and the tax declaration from the Assessor’s Office to ensure they match official records.

Compare with Records on File: Sometimes the documents on hand may have errors or outdated information. By comparing with records on file, you can confirm you’re reviewing the most accurate and up-to-date information.

Check for Annotations: The title may contain annotations or liens that don’t appear on the tax declaration. Annotations like mortgages or encumbrances could affect ownership rights and need careful review.

---

8. Engage a Licensed Real Estate Lawyer

Due diligence on title and tax declaration alignment may uncover issues requiring legal expertise. Consulting a real estate lawyer can clarify confusing details and prevent future legal complications.

Legal Advice on Discrepancies: A lawyer can investigate mismatches in ownership, lot details, or zoning classification, ensuring all information aligns.

Assistance with SPA: If the seller is unavailable and has appointed an Attorney-in-Fact, a lawyer can verify the validity and terms of the Special Power of Attorney (SPA) to ensure legal authorization.

---

Conclusion

Thorough due diligence to confirm that the title and tax declaration information aligns is essential for a smooth and secure real estate transaction in the Philippines. From confirming ownership to verifying exact property details, these steps safeguard your investment against potential disputes or legal challenges. With proper due diligence, you can confidently proceed with your real estate purchase.

For more assistance, you can reach out to Samuel O. Lao and Associates at +639173236123.