The Importance of Visiting the Local Assessor's Office in Property Due Diligence

Title: The Importance of Visiting the Local Assessor's Office in Property Due Diligence

When considering the purchase of a property, conducting due diligence is essential to ensure a smooth and secure transaction. One crucial aspect of this process is visiting the Local Assessor's Office. In this article, we will explore why a visit to this office is crucial and what specific checks you should perform during your visit.

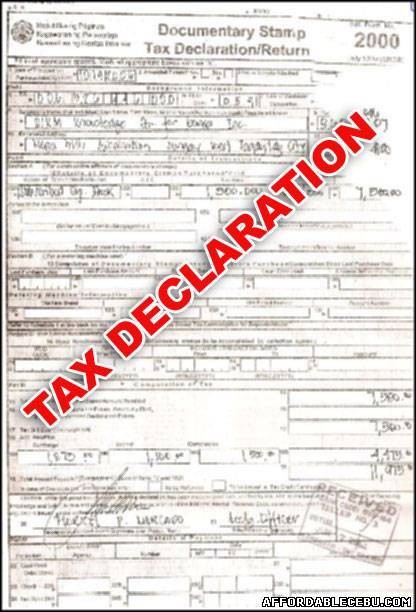

1. Obtain Certified True Copies of Tax Declaration

One of the primary reasons to visit the Local Assessor's Office is to obtain certified true copies of the property's Tax Declaration. These documents are essential as they provide vital information about the property, including its assessed value for tax purposes.

2. Tracer Back of Tax Declaration

To ensure the accuracy and legitimacy of the Tax Declaration, it's important to trace its history. This helps confirm that the property's tax records have been consistent over time and that there are no discrepancies or irregularities.

3. Check for Tax Clearance

Checking for tax clearance is crucial to confirm that the property's real property tax payments are up-to-date. Request the certificate of tax clearance, and if it's not current, ask for a statement of payables. This step ensures that you won't inherit any outstanding tax liabilities upon purchasing the property.

4. Look for Annotations

Examine the Tax Declaration for any annotations, such as liens, encumbrances, or adverse claims. If you find any annotations, consult a legal professional for further due diligence, as they may have legal implications that need to be addressed before proceeding with the purchase.

5. Verify Land Use Classification

Check the land use classification of the property, whether it's agricultural, residential, commercial, or industrial. Ensure that the classification aligns with your intended use of the property. If you plan to use it differently, inquire about the possibility of conversion before finalizing your decision to buy.

6. Assess Market Value

Determining the property's market value is essential for negotiations and understanding its worth in the current market. The Local Assessor's Office can provide you with information regarding the property's assessed value, which serves as a basis for valuation.

7. Tax Declaration for Buildings and Machines

If the property includes buildings or machinery, request the Tax Declaration for these assets. Pay attention to the noted market values, as they play a crucial role in property valuation.

8. Address Improvements

In cases where there are improvements, such as houses, but no Tax Declaration exists, it's important to address this issue before purchasing. Failure to do so could result in extra costs for registering the improvements, which are typically borne by the seller.

9. Certificate of No Improvement

If there are no improvements on the property, request a Certificate of No Improvement. This document is useful for tax computation and ensures you won't be charged for non-existent improvements.

10. Consult Professionals

While these tips are based on experience, it's essential to emphasize the importance of consulting with professionals, such as real estate broker, lawyers, and tax experts, for proper guidance during the property-buying process. Their expertise can help you navigate potential pitfalls and ensure a successful transaction.

In conclusion, a visit to the Local Assessor's Office is a critical step in property due diligence. It provides you with valuable information and documents necessary to make an informed decision when purchasing a property. Remember to conduct thorough research and seek professional advice to safeguard your investment.

#DueDiligence #TaxDeclaration #Scam

#Fraud #fake #RealEstate #Property

Tags: Due diligence Tax declaration Assessor Fake Scam Fraud Real Estate Property Land use