Tips for Performing Due Diligence on Tax Declarations when Buying Real Estate in the Philippines:

Tips for Performing Due Diligence on Tax Declarations when Buying Real Estate in the Philippines:

---

1. Obtain a Copy of the Latest Tax Declaration

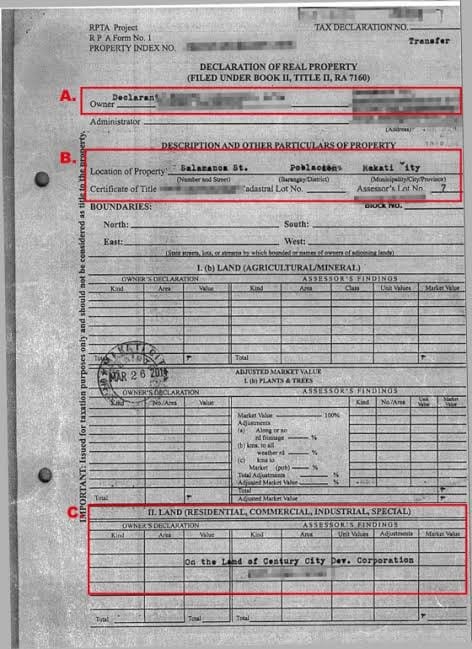

The Tax Declaration is an official document issued by the local assessor’s office that provides details on the property’s assessed value for tax purposes. This document is essential for verifying the property’s value, ownership history, and compliance with tax payments. Obtain a copy of the latest Tax Declaration from the local assessor’s office, and check the following:

Owner’s Name: Ensure it matches the name on the property title. If there’s a discrepancy, this could indicate incomplete or contested ownership.

Location and Property Details: Verify the property’s location, classification (e.g., residential, agricultural), and lot area in the Tax Declaration. This information should align with the property title and deed of sale.

---

2. Verify Payment of Real Property Tax (RPT)

Unpaid real property taxes can result in penalties or even lead to the property being auctioned by the local government. To confirm that taxes are up-to-date:

Request the Latest RPT Receipts: Ask the seller to provide the latest receipts for Real Property Tax payments. This will show that taxes have been settled and help avoid unexpected liabilities.

Check for Tax Clearance: Request a Tax Clearance Certificate from the city or municipal treasurer’s office, indicating that the property has no outstanding RPT liabilities.

Calculate Back Taxes: If there are unpaid taxes, calculate the total amount due, including penalties. You may need to negotiate with the seller to settle these before the sale.

---

3. Confirm Property Classification and Zoning

The property’s classification in the Tax Declaration affects its tax rate and allowed use. Verify that the classification (e.g., residential, commercial, agricultural) aligns with your intended use for the property.

Confirm Zoning Compliance: Check with the local zoning office if the property’s classification is consistent with current zoning regulations. Misaligned classification and zoning can lead to higher taxes or restricted use.

Look for Special Classifications: Some properties may have special classifications that affect their tax obligations, like eco-tourism sites or government-acquired properties.

---

4. Review the Assessed Value and Fair Market Value

The assessed value is used to calculate RPT and is typically a percentage of the fair market value as assessed by the local government.

Verify Consistency: Ensure the assessed value on the Tax Declaration matches recent RPT receipts. Any inconsistency could indicate an incorrect or outdated assessment.

Determine Property Valuation: Compare the property’s fair market value in the Tax Declaration with recent sales in the area to ensure it aligns with the current market. This can also help you calculate transfer taxes and fees.

---

5. Ensure Validity of the Tax Declaration

A valid Tax Declaration is important for confirming the property’s status and any improvements made to it. Here’s how to check:

Check for Updated Declarations: When property improvements are made, such as building a structure on vacant land, the Tax Declaration should be updated to reflect the improvements. Ask the seller to provide updated declarations if applicable.

Investigate Long-Gap Declarations: If the last update is several years old, consult the assessor's office for records of any assessments or missed declarations. An old declaration may indicate unreported property changes or delinquent taxes.

---

6. Request a Certified Copy of the Tax Declaration

Ensure authenticity by requesting a certified true copy of the Tax Declaration from the local assessor’s office. This copy will confirm the document’s legitimacy, verify that no unauthorized alterations have been made, and ensure it matches official records.

---

7. Investigate Potential Red Flags in the Tax Declaration

Certain entries in the Tax Declaration may signal potential issues. Red flags to watch for include:

Multiple Owners Listed: This may indicate co-ownership or inherited property. Ensure all co-owners are in agreement with the sale.

Discrepancies with the Title: Differences between the Tax Declaration and title details could mean boundary disputes, incorrect lot area, or tax misclassification.

Annotations on the Property: Any notes indicating legal disputes, pending transactions, or liens should be examined with legal assistance.

---

8. Consult a Real Estate Lawyer for Complex Situations

Complex scenarios like multiple owners, unlisted improvements, or unusual property classifications may require a real estate lawyer for proper due diligence. A lawyer can clarify ownership, negotiate terms, and resolve potential discrepancies in the Tax Declaration to avoid legal complications.

---

Conclusion

Performing thorough due diligence on the Tax Declaration is essential to secure a smooth and problem-free property purchase in the Philippines. By verifying the Tax Declaration, checking for outstanding RPT, and consulting with professionals when necessary, you protect yourself from unexpected liabilities and ensure a legally sound transaction.

For further assistance, feel free to reach out to Samuel O. Lao and Associates at +639173236123.

Tags: Let's talk Business Tax Declaration Real Estate Due Diligence