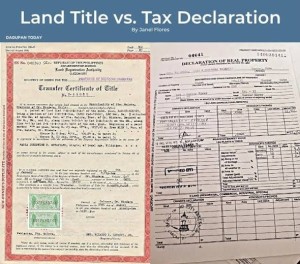

Tips for Performing Due Diligence on Tax Declarations when Buying Real Estate in the Philippines:

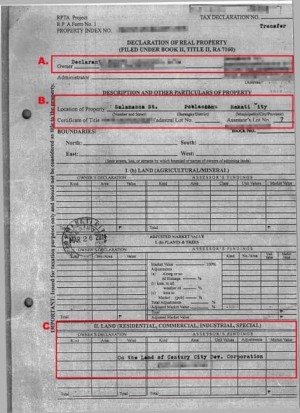

Tips for Performing Due Diligence on Tax Declarations when Buying Real Estate in the Philippines: --- 1. Obtain a Copy of the Latest Tax Declaration The Tax Declaration is an official document issued by the local assessor’s office that provides details on the property’s assessed value for tax purposes. This document is essential for verifying the property’s value, owners...

Read more